01

1 HourZakho prepares for summer tourism season with restoration efforts

02

1 HourLufthansa, United Airlines assess flight resumptions amid regional tensions

03

3 HoursInvestigation launched following explosion at Kalsu military base

04

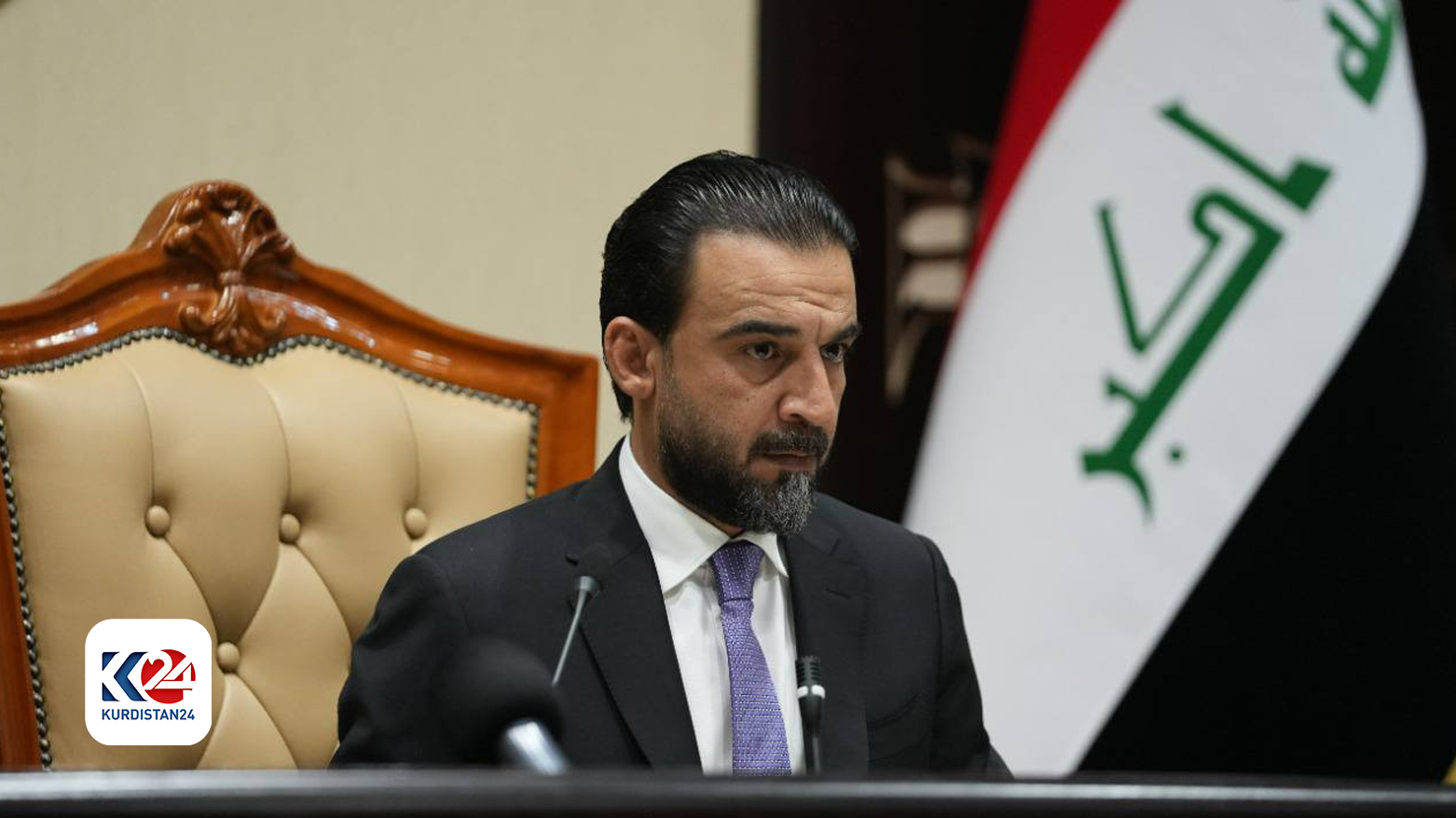

3 HoursUncertainty surrounds selection of new Iraqi parliament speaker

05

4 HoursKurdish language set to be included in German driving license examinations

06

5 HoursExplosions rock Kalsu Military Base south of Baghdad

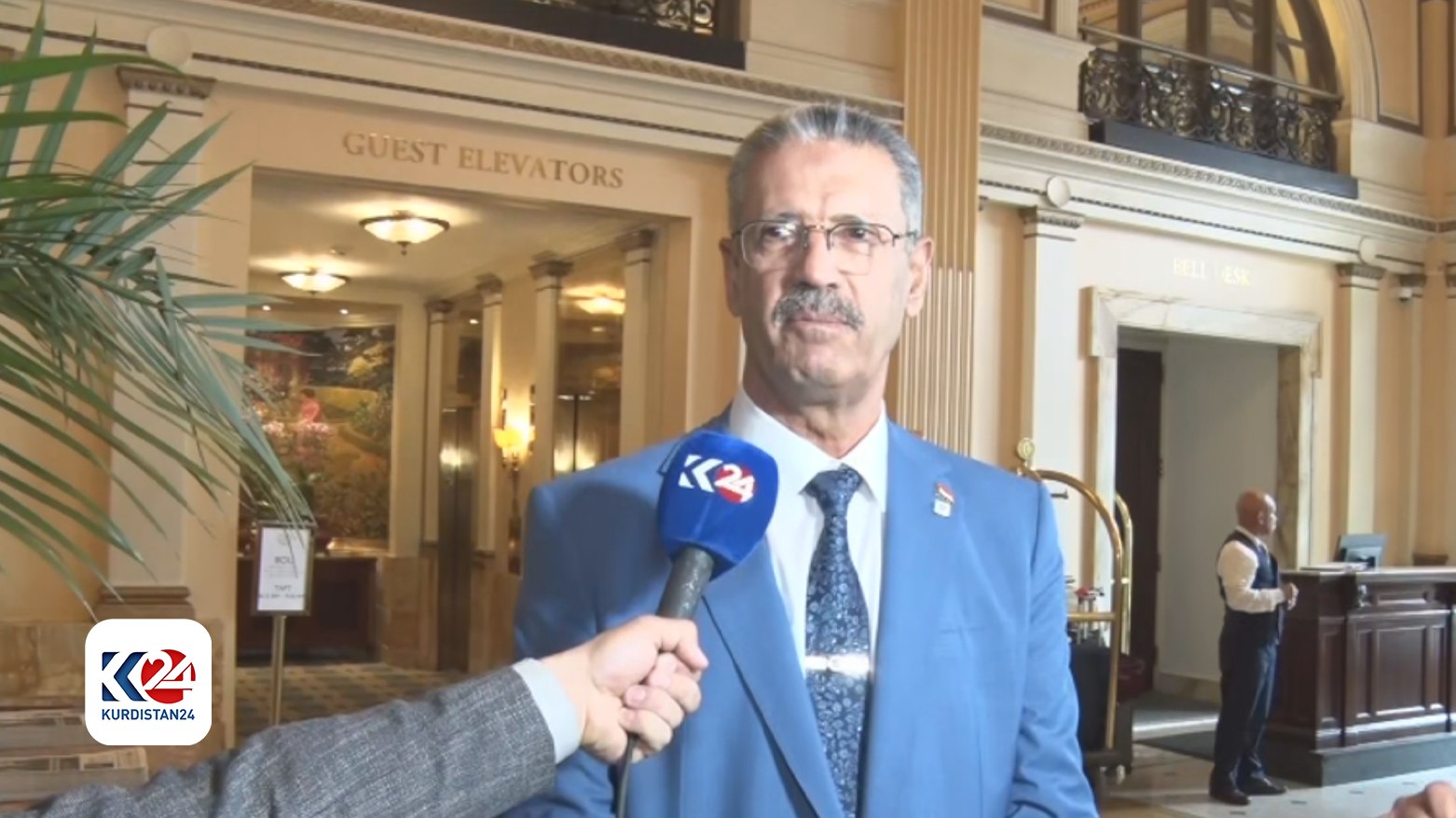

Iraq preparing to amend its budget law

16 Hours

Iraq, Kurdistan Region in talks to resume oil exports, says Iraqi Oil Minister

2024/04/17 22:25

.jpg)