U.S. Treasury Sanctions Iranian Shadow Banking Network Laundering Billions for Regime’s Nuclear and Terrorist Agenda

US sanctions 30+ in Iran's shadow banking network, targeting $ billions in oil & weapons financing. Treasury cracks down on Zarringhalam-linked laundering operations evading sanctions.

By Ahora Qadi

ERBIL (Kurdistan24) - In a sweeping action aimed at disrupting the financial lifelines of the Iranian regime, the United States Department of the Treasury has designated more than 30 individuals and entities involved in a vast shadow banking network that has laundered billions of dollars for Tehran’s oil, petrochemical, and weapons programs. The announcement marks the first sanctions package targeting Iran’s clandestine banking infrastructure under the current administration’s enhanced pressure strategy.

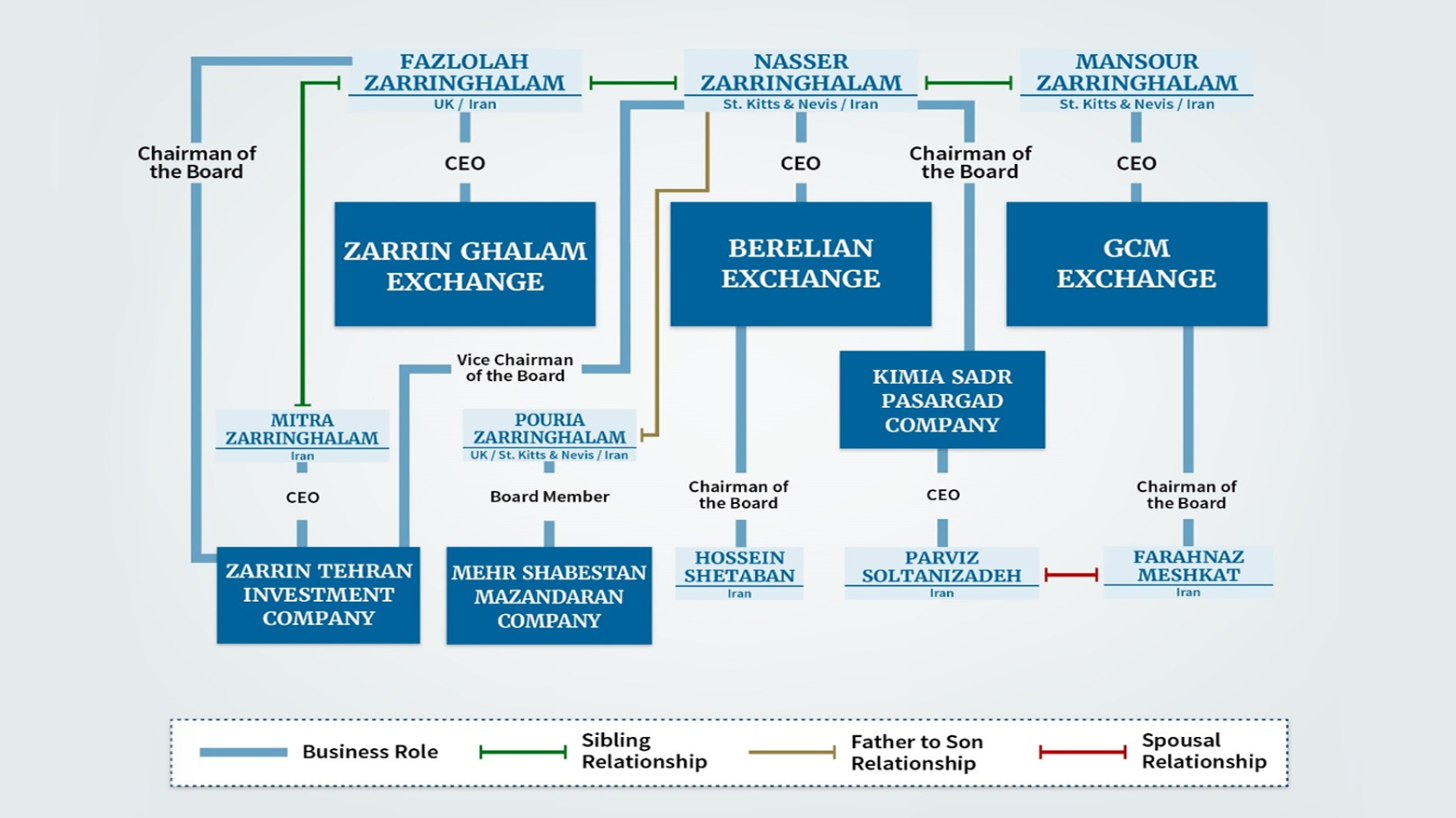

According to the Treasury’s Office of Foreign Assets Control (OFAC), the network—centered around Iranian nationals Mansour, Nasser, and Fazlolah Zarringhalam—used a system of front companies in the United Arab Emirates and Hong Kong to move illicit oil revenues and fund operations linked to Iran’s missile and nuclear development, as well as support for regional terrorist proxies.

"Iran’s shadow banking system is a critical lifeline for the regime through which it accesses the proceeds from its oil sales, moves money, and funds its destabilizing activities," said Secretary of the Treasury Scott Bessent in a statement. "Treasury will continue to leverage all available tools to target the critical nodes in this network and disrupt its operations, which enrich the regime’s elite and encourage corruption at the expense of the people of Iran."

A Corrupt Parallel System Undermining Global Sanctions

The shadow banking architecture allows sanctioned Iranian military entities and regime officials to access the international financial system by masking transactions through Iranian exchange houses and offshore shell companies. OFAC emphasized that the system operates as a "parallel banking system" designed to evade regulatory oversight and exploit weak jurisdictions to facilitate the flow of illicit funds.

Whistleblowers inside Iran have reported massive embezzlement and widespread corruption tied to this financial structure, underscoring the regime’s use of these mechanisms to enrich elites while the broader population suffers economic hardship.

The Zarringhalam Family at the Core of Illicit Financing

The Zarringhalam brothers orchestrated this vast laundering operation, enabling sanctioned actors to receive payments from the sale of petroleum and other commodities. OFAC has also sanctioned their family’s holdings, including Zarrin Tehran Investment Company and Kimia Sadr Pasargad Company—both active in Iran’s oil, gas, and construction sectors.

Among those designated are Mitra Zarringhalam, CEO of Zarrin Tehran Investment Company; Parvis Soltanizadeh, a board member at Kimia Sadr Pasargad; Hossein Shetaban and Farahnaz Meshkat, senior figures in the Berelian and GCM Exchanges; and Pouria Zarringhalam, a construction executive. Their affiliations demonstrate the regime’s ability to infiltrate and exploit diverse sectors of the Iranian economy through family-run enterprises.

Sanctions Enforcement and Legal Implications

The action is taken under Executive Orders 13902 and 13846, which authorize targeting Iran’s financial, petroleum, and petrochemical sectors. As a result, all U.S.-linked property and interests belonging to the sanctioned individuals and entities are now blocked, and American persons are prohibited from engaging in any transactions with them.

Treasury’s Financial Crimes Enforcement Network (FinCEN) has also issued an updated advisory to help financial institutions detect suspicious activity linked to Iranian oil smuggling and weapons procurement operations. The advisory outlines typologies and red flags to mitigate risk exposure for banks and firms operating globally.

OFAC reiterated that violations of these sanctions—whether by U.S. or foreign entities—may result in civil or criminal penalties. The department also clarified that its sanctions are ultimately intended to pressure behavioral change, not merely to punish.

This sanctions package is the latest demonstration of Washington’s intent to dismantle Iran’s economic scaffolding that underpins its destabilizing regional agenda. It comes as the administration accelerates a maximum pressure campaign designed to curb Tehran’s ambitions and support for proxy forces amid rising regional tensions.