Trump Signals Davos Talks on Greenland as Tariff Threats Rattle Europe’s Top Economy

Germany warns of economic fallout amid renewed transatlantic tensions driven by geopolitical dispute.

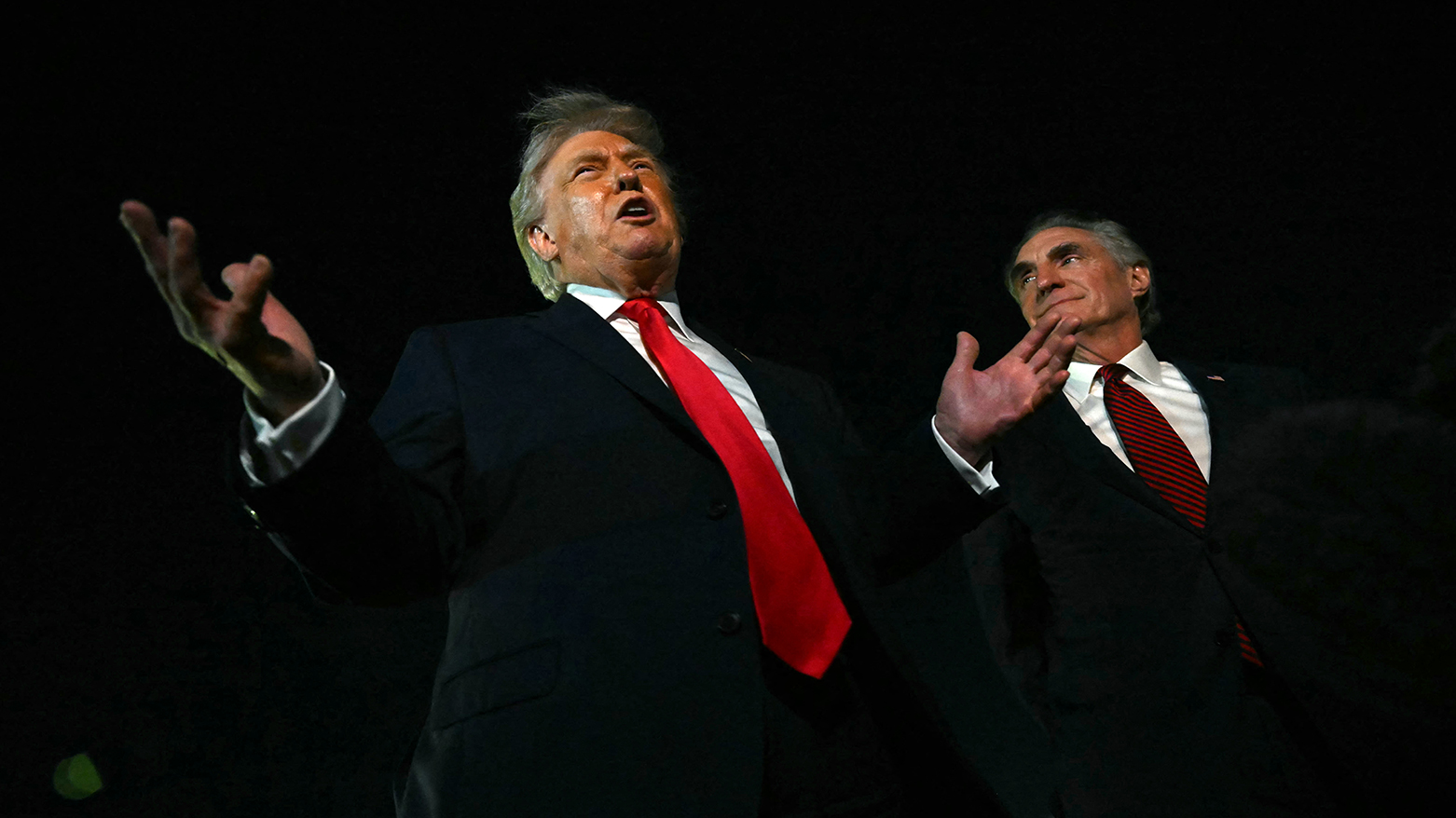

ERBIL (Kurdistan24) — US President Donald Trump said Monday he had agreed to hold a meeting with “various parties” at the World Economic Forum in Davos to discuss his push to take over Greenland, a move that has already triggered fresh tensions with Europe and shaken Germany’s fragile economic recovery.

In a post on his TruthSocial platform, Trump said he had held a “very good telephone call” with NATO Secretary General Mark Rutte regarding Greenland and confirmed that discussions would take place this week in Switzerland on the sidelines of the annual Davos gathering of global political and business leaders.

Trump’s remarks come as his latest tariff threats against Europe—linked not to trade imbalances but to opposition to his Greenland ambitions—have sent shockwaves through Germany, the bloc’s largest economy.

Economists and business leaders warned that additional US tariffs could derail hopes of a modest rebound after years of stagnation. “For Germany, these new tariffs would be absolute poison,” Carsten Brzeski, an economist at ING, told AFP, adding that the renewed uncertainty “clearly jeopardizes the fragile recovery underway.”

Germany posted just 0.2 percent GDP growth in 2025 after two consecutive years of recession, weighed down by high energy prices, weakening demand from China, and intense competition from Asian manufacturers.

Expectations for 2026 had recently improved, supported by large-scale public spending to modernize infrastructure and rebuild the armed forces, with the government forecasting 1.3 percent growth.

Those projections were cast into doubt after Trump, angered by resistance to his desire to seize Denmark’s autonomous territory of Greenland, threatened additional tariffs of up to 25 percent on products from eight European countries, including Germany.

The announcement rattled markets, pushing stocks lower and driving investors toward safe-haven assets such as gold. German businesses reacted with a mix of disbelief and frustration.

“Greenland is taking this madness to extremes,” said Thorsten Bauer, co-head of laser manufacturer Xiton Photonics, speaking to AFP during a business trip to the United States.

The Federation of German Industries condemned what it described as “an inappropriate and damaging escalation for all parties,” warning that it was placing “enormous pressure on transatlantic relations.”

The German Association of Wholesalers, Exporters and Service Providers went further, branding the threat “grotesque” and stressing that “democracy and freedom cannot be wiped out by punitive tariffs,” while reaffirming support for Denmark.

Trump’s latest warning follows a July agreement between Washington and Brussels to cap tariffs on most EU exports at 15 percent, with the majority of US-bound European goods exempt from duties. While some critics saw that deal as unbalanced, many German firms welcomed the certainty it appeared to provide.

“Our members largely kept a cool head during last summer’s tariffs debate and waited patiently,” the German Association of Small and Medium-sized Businesses said. “But waiting patiently cannot go on forever.”

The group described Trump’s policies as “poison for the global economy and free trade,” while urging Europe not to yield to pressure and to respond “quickly and decisively” if tariffs are imposed.

European diplomats have pledged a firm response should Washington follow through, and Manfred Weber, a leading conservative German lawmaker in the European Parliament, said final ratification of the July tariff deal was now “on ice.”

Analysts warned that a prolonged dispute could damage trade between the United States and Germany worth more than €250 billion annually. Andrew Kenningham of Capital Economics estimated that sustained tariffs could shave between 0.2 and 0.5 percent off eurozone GDP, with Germany bearing the brunt, though he expressed doubts that the measures would ultimately be implemented as threatened.

The renewed uncertainty comes at a particularly sensitive moment for Germany’s automotive sector, which had hoped last year’s tariff battles were over. “With Greenland, it comes out of the blue,” said Pal Skirta, an automotive analyst at Metzler Bank.

“You can’t justify it by macroeconomic logic. This is the clearest proof yet that the tariffs are driven by politics, not economics.”

As Davos opens, European leaders and investors will be watching closely to see whether talks can defuse a dispute that risks escalating into a broader transatlantic trade confrontation.