UAE Accelerates Global AI Ambitions with Massive Desert Campus

Abu Dhabi’s multibillion-dollar push positions the Emirates as an emerging hub for next-generation computing, research, and sovereign AI capabilities.

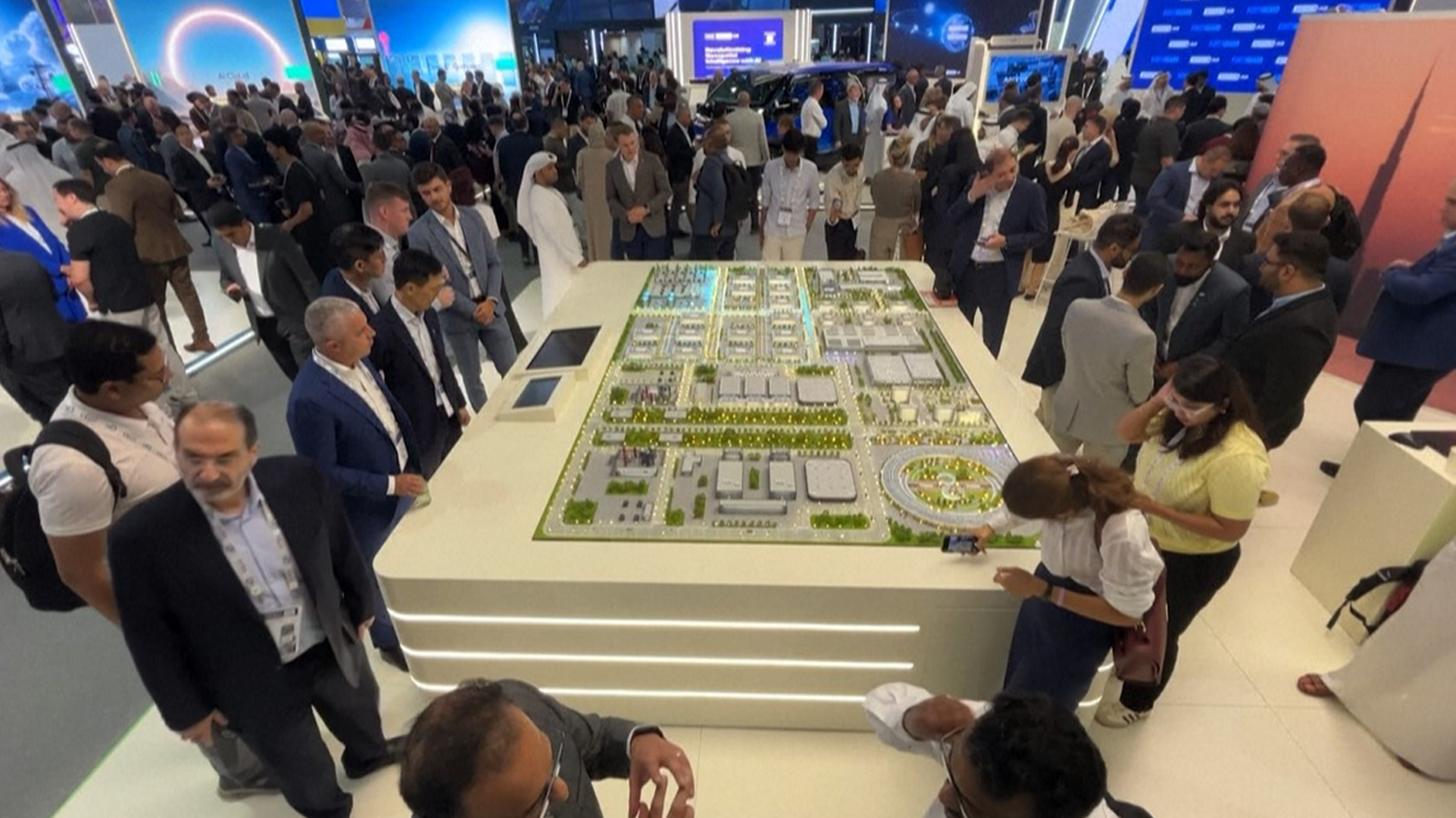

ERBIL (Kurdistan24) — A vast artificial intelligence complex is taking shape deep in the Abu Dhabi desert, marking the United Arab Emirates’ most ambitious step yet toward transforming its oil-based economy into a global technology powerhouse. The sprawling development—covering an area equivalent to one quarter of Paris—will host data centers powered by five gigawatts of electricity, making it the largest such facility outside the United States.

Towering cranes and fast-moving construction teams are building long, low structures that will eventually serve as the operational core of Khazna Data Centers, a subsidiary of Emirati AI conglomerate G42.

Once fully operational, the facility will deliver storage and computing capacity across a radius of 3,200 kilometers, reaching as many as four billion people, according to Johan Nilerud, Khazna’s chief strategy officer.

For the UAE, the project signals a decisive step toward a post-oil economic model. Since the 1960s, the country’s rapid ascent—from scattered tribal settlements to a regional diplomatic and commercial center—has been fueled by hydrocarbon revenues. Today, with global energy markets evolving, Abu Dhabi is betting that AI will anchor its next phase of growth.

“The UAE is punching above its weight because it's a very small country that really wants to be at the forefront,” Nilerud said, emphasizing the government's intent to attract international partners and build what officials describe as an “AI-native nation.”

Phase one of the campus, the one-gigawatt Stargate UAE cluster, is being built by G42 and will be operated by OpenAI, with backing from Oracle, Cisco, Nvidia, and other U.S. technology firms.

The momentum has been reinforced by Microsoft, which last month announced more than $15.2 billion in additional UAE investments by 2029, following a $1.5-billion injection into G42 in 2023.

A national project years in the making

The UAE’s push into AI began in 2017 when it created the world’s first ministerial portfolio dedicated to the sector and launched a national AI strategy.

G42 followed a year later, backed by the sovereign wealth fund Mubadala and chaired by Sheikh Tahnoon bin Zayed Al Nahyan, the brother of the UAE president. The firm now employs more than 23,000 people and provides a range of AI-driven products.

Authorities say more than $147 billion has been invested in AI since 2024, including up to €50 billion for a one-gigawatt AI data center in France. Abroad and at home, the Emirates are pursuing what experts describe as a multi-layered strategy—supporting infrastructure, education, and local innovation simultaneously.

“AI, like oil, is a transversal sector, which can potentially have a leverage effect and an impact on different activities,” said Jean-Francois Gagne of the University of Montreal.

In 2019, Abu Dhabi inaugurated the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI), the world’s first AI-focused university. In 2023, the UAE made AI a mandatory subject in public schools beginning in kindergarten.

MBZUAI and Abu Dhabi’s Technology Innovation Institute (TII) have since developed competitive generative models such as Falcon, which now includes an Arabic version.

To reduce dependence on foreign hardware and expertise, the country has invested heavily in homegrown research. TII recently launched a joint lab with Nvidia to advance generative models and robotics.

“Sovereignty and self-sustainability and domestic customization of technology to local needs are all very, very important,” MBZUAI president Eric Xing said.

Energy, capital, and geopolitics

While the US and China dominate the global AI race, analysts say the UAE enjoys distinct advantages: abundant energy, deep financial reserves, and the agility of a centralized political system capable of deploying large-scale investments rapidly.

The Emirates’ status as a trade and services hub—where nearly 90 percent of the population is expatriate—also positions it favorably in the talent competition, including against its Gulf neighbor and rival, Saudi Arabia.

Still, Abu Dhabi must navigate a complex geopolitical landscape. Its AI ambitions rely on advanced semiconductor imports, making Washington and Beijing critical partners.

After months of high-level lobbying, the US last month approved the export of advanced Nvidia chips to both the UAE and Saudi Arabia.

“They clearly don’t want to be dependent on China, but that doesn’t mean they want to depend on the US either,” said Gagne, describing the Emirates’ balancing act.

Despite massive financial commitments and early successes, technology experts caution that the global AI sector remains unpredictable.

“Right now, we don’t know what the right strategy is, or who the good players are,” Gagne said. “Everyone is betting on different players, but some will lose, and some will win.”